Intelligence

- Information›

Foreign exchange or 'Forex' trading carries serious risks, with online fraudsters exploiting the volatile market to get their hands on investors' capital. At CFTC, we perform rigorous Forex scam investigations to help victims uncover the culprits behind the crime and recover their losses.

Harnessing a worldwide network of whistleblowers, expert witnesses and international partner agencies, CFTC is a global leader in Forex fraud investigations. Equipped with extensive experience in evidence gathering, our licensed investigators unravel fraudulent Forex trading operations to reveal the criminals and money trails behind them.

This actionable intelligence and information can be used to help recoup your money and prosecute the scammers who pocketed it. Book a consultation with CFTC to arrange an investigation today.

Although forex trading is not always fraudulent, this highly-technical market is prolific with financial scams that target all levels of investor.

Forex fraudsters operate out of call centres in countries such as Cyprus, Israel, Ukraine, Armenia, Moldova, Georgia, Bulgaria, South Africa, Thailand, Philippines, Indonesia, Malaysia, Cambodia and Myanmar. These scammers lure investors in with the promise of high returns and specialist support, posing as industry experts despite having little to no experience in trading foreign currencies – nor any intention of doing so.

Instead of investing the capital they receive, these criminals funnel it through an intricate money trail for their own use. By the time you realise that the trades are fraudulent, your funds have vanished.

If this sounds all too familiar, please contact our forex scam investigators as soon as possible to discover how we can assist your case.

Our cyber investigators, analysts and researchers have been gathering evidence to hunt down fraudsters across the globe for years. With our exceptional investigative skills on your side, you can maximise the likelihood of recovering your losses.

CFTC has extensive experience working closely with state, federal and international law enforcement agencies. Our investigators can also join forces with local and foreign correspondent lawyers to discover money trails and hidden assets on any continent.

With direct access to local databases, expert witnesses in cyber fraud, cybercrime and cyber forensics, and a network of confidential informants, CFTC utilises a range of techniques to complete rigorous investigations into even the most complex Forex scams operating from foreign countries.

No matter where your investigation takes place, CFTC will prepare a solid brief of evidence for use in criminal proceedings in the appropriate jurisdiction. Armed with proof of fraud, and the identities of those involved, you will be able to file complaints to prosecute the offender and take steps to recoup your money.

CFTC investigators have been instrumental in helping international law enforcement agencies crack down on organised cybercrime groups, providing pivotal evidence that has resulted in major police raids, arrests and prosecutions around the world.

Our dedicated fraud investigators conduct every investigation with unfaltering professionalism, sensitivity and discretion. To ensure client privacy is protected, we encrypt all personal data and will only ever disclose case information with consent.

Signal sellers are managed account companies, retail firms, asset managers or individual traders who provide a software system that flags advisable times to purchase or sell a currency pair. These suggestions are based on professional insights, purporting to help inexperienced traders earn money in return for a recurring fee.

While some legitimate signal sellers perform trade functions as promoted, it pays to do your due diligence. Otherwise, Forex scammers could snatch your money and disappear.

A Forex robot is a software program that utilises algorithms to automatically buy and sell currency. The parameters and optimisation codes employed by genuine Forex robots are assessed by independent bodies to ensure their validity. Legitimate brokers often offer these Forex robots as value adds.

However, some scammers sell fraudulent robots that trade at random. Although claiming to be able to make you money around the clock, these untested systems can instead cause you to lose your hard-earned savings.

Some Forex scammers target beginner investors who are looking for an expert to handle trades on their behalf. Posing as an investment firm that provides managed Forex accounts, the fraudster often demands a fee or commission charge in exchange for their professional services. But instead of maximising your returns, they report false profits and drain your account.

A scammer may also pretend to be a registered Forex broker, swindling investors with fake funds. They may assume the identity and registration number of a legitimate Forex broker, even creating a practically-identical website to lure you in and convince you to hand over your money.

Forex pyramid schemes purport to be investment groups, reeling in victims by offering access to exclusive trading advice in return for a membership fee. Existing members are promised a commission to recruit more members, in turn moving up the 'pyramid' of promised profits.

Similarly, a Forex scam can take the form of a Ponzi scheme, advertising Forex funds that ensure a strong return in a short timeframe. Typically, the scammers only request a minor upfront investment and may even pay the first few investors their promised returns to make the scheme appear effective. These investors are then convinced to persuade their friends and family to join.

In both pyramid and Ponzi schemes, distributed earnings derive from membership fees as opposed to Forex trading wins. In both cases, the investment does not actually exist. When recruits start to dwindle, the original orchestrators close the scheme and pocket your money.

A handful of strategic questions can help you to confirm whether you are liaising with a credible professional or a Forex scammer. To help you avoid a Forex scam, ask the following questions before you sign up for an account.

Typically, the most prominent red flag of a Forex scam is the promise of unlimited profits with little or zero financial risk.

First off, 100% guarantees are simply not possible – and if there was some way to make them happen, traders would keep this winning formula to themselves.

Furthermore, successful Forex trading demands expertise and patience. It is not the avenue for quick and effortless returns. If you are being assured otherwise, walk away and do your own research.

A beginner trader should approach every opportunity with caution, analysing the data independently and testing their functions on a demo account before investing a cent. This will help you to avoid falling victim to a Forex scam.

The bottom line: If it sounds too good to be true, it usually is.

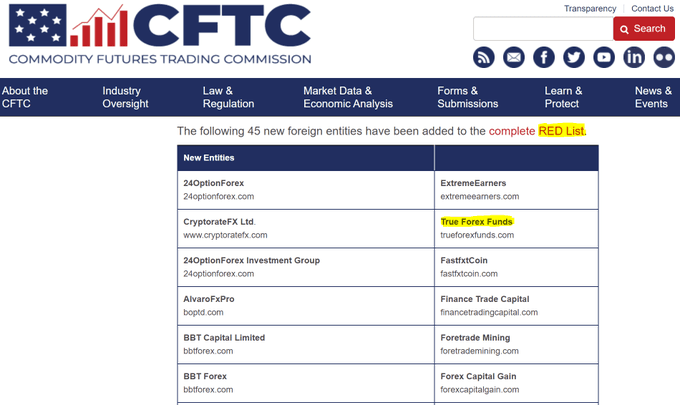

Forex scams are often orchestrated by unregulated brokers, who are not obliged to report to an authority. In other words, they can use deceptive tactics, such as blaming system glitches, to steal your money.

Alternatively, many Forex scam brokers are regulated by foreign governing bodies with minimal oversight. Consequently, it is critical that you only engage brokers with a robust reputation and first-rate regulation, such as by ASIC in Australia.

To check your Forex broker's regulatory status, take a thorough look at the bottom of each page on their website. Genuine Forex brokers always demonstrate evidence of their legitimacy online, as they are legally required to present certain risk disclaimers and regulatory information within their website footer.

However, as some Forex scammers may include deceptive details to appear above board, it is strongly recommended that you confirm their registration with the relevant authority by requesting a list of regulated companies.

Often, a Forex scam can involve email spam that requests personal information, including your full name, phone number, home address, birthday and more.

Never share these details with anyone who you do not know and trust completely – no matter how high the returns they are promising. Be wary of brokers who fail to supply you with a written risk disclosure statement. And if they do, always double check the fine print.

When an unregulated broker advertises an unusually large cash bonus with vague details and little context, you are likely looking at a Forex scam.

Offering a signup bonus with a lack of practical information is a typical scam strategy. This tactic persuades website users into clicking on a link that brings them straight to the account signup page – where they will steal your funds.

Never give your hard-earning savings to someone who cannot provide you with genuine background information, such as their professional credentials, physical location, team members, client reviews and other key elements.

Orchestrators of a Forex scam do not want to be associated with any names, places, or contact details in case the authorities try to crack down on their operations.

CFTC has a strong operations centre in Washington D.C USA, and in the heart of Asia, which is the world's largest hub for many types of cybercrime. We also have offices elsewhere around the globe in Europe, Canada and South Africa.

Before choosing any other recovery service, ask for a video call and confirm their licensing authority, company registration, and credentials with law enforcement.

CFTC Recovery expertise and knowledge are trusted and recognised by leading state, federal and international law enforcement agencies.

NSW Police Force Master Investigation Licence: 410843633 - Florida License Number: A1900003

Awarded multiple Plaques of Appreciation by the Philippine National Police, Anti-Cybercrime Group

Certificate of Appreciation as a subject matter expert.

Awarded Certificate of Appreciation from Californian Association of Licensed Investigators